Construction employment in the UK has fallen to its lowest level in more than two decades. The latest government data shows a 15 per cent drop in site employment since before Covid, which reflects a wider slowdown in construction activity across housing, commercial work and infrastructure.

This decline is not a sign of a shortage of architecture and engineering professionals, but it signals fewer projects progressing to site and a reduction in construction investment overall. When delivery slows, confidence falls, pipelines become harder to predict and competition increases for the projects that do move forward.

For larger A&E practices, a slower construction market does not create new problems so much as it amplifies the ones that already exist. Boards still need reliable information to steer the firm. Different offices and disciplines still need to report in a consistent way. Margins still need to be protected, often more carefully than before. And directors often find themselves carrying even greater responsibility for financial clarity, even though many of the internal processes in place were built for a much smaller business.

In times like these, the firms that stay steady are the ones that bring more structure to the way they work. They take a measured, disciplined approach, rely on clear data and build alignment across teams so everyone is using the same playbook.

With that foundation in place, it becomes far easier to navigate uncertainty with confidence, because consistency across teams is often the difference between firms that cope and firms that perform.

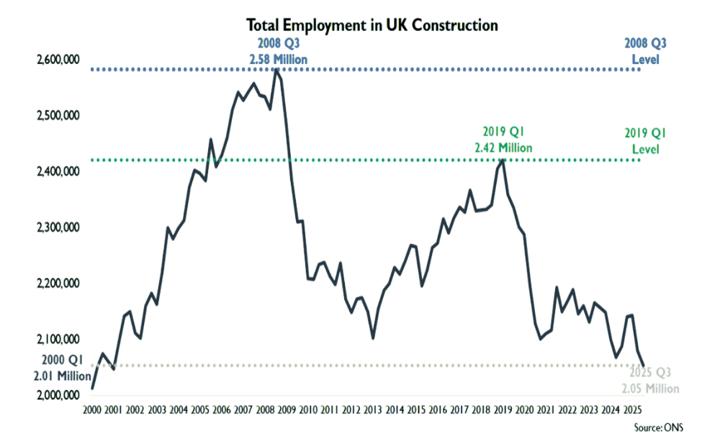

The long-term picture reinforces this slowdown. As shown below, total construction employment has been decreasing for more than a decade. After previous peaks in 2008 and 2019, the workforce has continued to shrink, falling to just over 2.05 million people in Q3 2025. This reduction is not caused by a shortage of architects or engineers. It simply mirrors the lower level of work progressing to site, particularly in housing and commercial development.

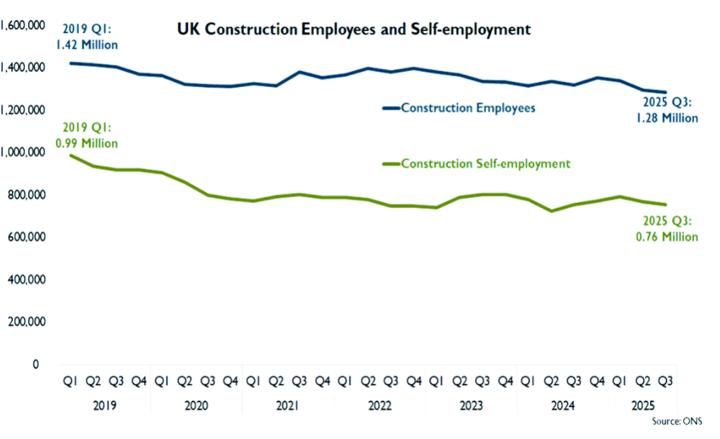

The decline is visible across the two main parts of the workforce. Employee numbers within construction have fallen by around 140,000 since 2019, while self-employment has dropped by almost a quarter of a million. These shifts reflect reduced sector activity rather than a shortage of professional design staff. They underline a quieter market overall, where fewer projects are being delivered and confidence has weakened.

Here are five practical ways larger practices are strengthening resilience in a slower market.

1. How can larger practices create consistent reporting across all offices and teams?

In a slower market, directors need a clear and consistent view of performance. This is difficult when one office uses spreadsheets, another uses legacy software and teams interpret key metrics in different ways. When reporting is fragmented, decision making becomes slower and less reliable.

Larger practices are addressing this by creating a single set of definitions for profitability, utilisation, earned value, pipeline and overall performance. Once the business agrees on how these metrics are calculated, reporting becomes faster and far more credible at board level. The firms that make this work are the ones that keep systems and processes simple enough for teams across every office to adopt consistently.

This consistency also sharpens the A&E profitability insights that directors depend on when the market is slower and decisions carry more weight.

Action tip:

Run a quarterly alignment session with operations and finance. Review how each team currently calculates the same five core metrics. Agree on a single version of each. Document it clearly and embed it into weekly and monthly reporting. This simple piece of governance improves accuracy across the entire practice.

As part of this, consider consolidating reporting into one live version of the truth so that teams are always working from the same, up to date information. Tools like Live Sheets can support this approach by reducing duplication and helping teams stay aligned.

2. How should firms prioritise the right projects to protect margins in a slower market?

When the market slows, it is natural to want to win more work. The risk is taking on too many small or low margin jobs that keep teams busy without strengthening the business. Several firms in the industry are already reassessing their project mix and becoming more intentional about what they pursue.

High performing firms are scoring projects by margin potential, client reliability and delivery complexity. This helps directors allocate senior time to the opportunities that genuinely support financial stability, rather than spreading limited capacity across work that does not return value.

For firms reassessing their project mix, it can be helpful to understand where margins are typically won or lost.

Action tip:

Introduce a simple scoring model for every bid or new instruction. Assess the likely margin, the strategic value and the level of risk. Projects that do not meet your threshold should trigger a review of pricing, scope or resourcing. This encourages disciplined decision making without slowing down the pipeline.

3. How can larger practices build a weekly operational rhythm that improves performance?

When fewer projects are progressing to site, it becomes even more important to monitor performance regularly. Monthly financial reports arrive too late to influence outcomes. Larger firms are moving to weekly visibility that combines financial and operational data so that teams can act early.

A short, consistent review helps leaders spot early signs of drift. It also strengthens communication between disciplines and offices, which is essential when commercial pressure increases.

Action tip:

Hold a 15 minute weekly meeting that follows a simple structure. Review current utilisation, the top three project risks and the upcoming resourcing picture. Keep the session concise and action focused. This rhythm helps teams address issues before they affect profitability or client relationships.

4. How can simplifying internal workflows free capacity across a larger firm?

In quieter markets, inefficiencies become more visible. Staff often spend hours entering the same data into multiple systems or reconciling spreadsheets that were designed for smaller firms. These manual processes reduce productive hours and increase frustration.

Simplifying workflows does not always require new tools. Many firms begin by reviewing their internal processes and removing duplicate steps. Even small adjustments can release enough time for project teams to focus on delivery and business development.

Action tip:

Ask each office to identify the three administrative tasks that consume the most time. Choose one to simplify each quarter. Examples include creating shared templates for fee proposals, standardising invoicing steps or reducing the number of approval layers for internal reporting. The gains accumulate quickly across 50 to 100 staff.

5. How can firms make visibility a shared cultural practice, not just a reporting task?

In slower markets, it is the firms with strong habits that perform best. Visibility is not only about dashboards or reports. It is a cultural practice that helps teams understand how their decisions influence profitability and client outcomes.

The most resilient firms encourage project leads to engage with live data regularly. They use it to inform conversations, allocate resources and validate decisions. This creates a culture where people act early, take ownership and feel connected to the commercial direction of the business.

Action tip:

Ask project teams to review their performance data together at the start of each week. Encourage three questions. What went well last week. What is at risk. What needs to change. This builds shared awareness without adding unnecessary administration.

The Bottom Line

The fall in construction employment reflects a quieter market, not a shortage of design professionals. For larger architecture and engineering firms, the priority is to maintain clarity, consistency and confidence in an environment where pipelines are less predictable.

Firms that standardise reporting, focus on profitable work, simplify internal processes and build strong operational habits will remain stable and competitive, even when the wider sector is slow. These are the practices that turn uncertainty into an opportunity to run leaner, work smarter and make better decisions